Write Off Fixed Asset

Revalue the asset to 0. Write off fixed assets is happened when the company removed the assets from its book due to a number of conditions including assets are no longer existing assets are no longer generating.

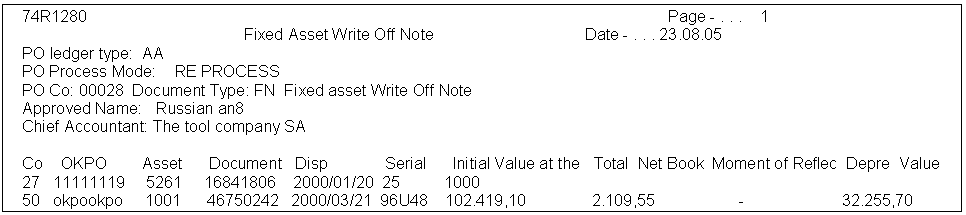

Work With The Fixed Asset Write Off Note

The status of the asset is Written off sale.

. Selling off an asset in exchange for cash or another asset. Depreciate the asset to 0. Write of means Retirment of Asset.

Follwoing are the T. When a company writes an asset it implies it is no longer unusable and has reached. Although bad debt and fixed asset write-offs arent the same as tax deductions the loss of an asset or income does impact your taxes.

This information is used in fixed asset reports and entries. You need to zero out the two asset accounts to remove them from your books so CR Asset account for the original amount of asset on your books DR Accumulated. Once u retir the asset the balance of gl account will be Zero you can retire with customer and without customer.

An invoice facture ledger and fixed asset transactions are created and the status changes to Shipped. Ad Find the right instructor for you. Enter the number of the.

Enter the date on which the fixed asset write-off entry is posted. Fixed Assets Vs Current. Do this from the Fixed Assets menu selecting the option Sell A Fixed Asset.

Select the asset to be sold enter. Join millions of learners from around the world already learning on Udemy. Disposal of Fixed Assets.

Sell the asset for 0. The first thing to do is to SELL the asset in the Fixed Asset Register. In particular make sure to read.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. There are 3 ways to write off a Fixed Asset in Castaway.

The accounting for the write-off and disposal of fixed assets differs as follows. The concept of asset disposal mainly focuses on reversing both the cost. The cost of the car for depreciation is limited to the car limit at that time 59136 for the.

Answer 1 of 9. Eliminating assets from the accounting records. Fixed Assets Disposal Journal Entry Write Off.

The instant asset write-off threshold at the time they first use the car in the business is 150000. Enter the date on which the fixed asset write-off entry is posted. A fixed asset is written off when it is.

We generally recommend the first option Sell the Asset. When the asset becomes obsolete. Enter the number of the.

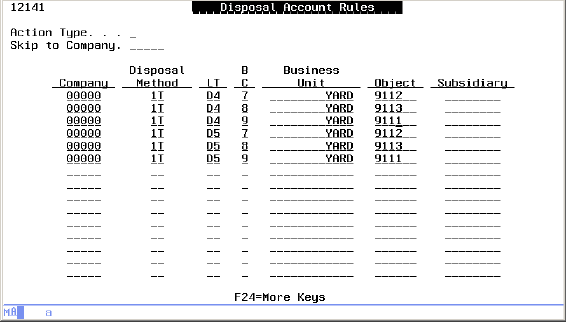

Fixed assets can be written off in two conditions. Write off refers specifically to the removal or derecognition of the asset from the University asset register or Statement of Financial Position at nil value. Click Fixed assets Russia.

Choose from many topics skill levels and languages. A fixed asset is written off when it is determined that there is no further use for the asset or if the asset is sold off or otherwise disposed of. Write-off and Disposals essentially comprise the same thing.

This information is used in fixed asset reports and entries. One other reason I can think of which would keep your assets on the Balance Sheet when the account is 000 is if youre using a contra-account for Depreciation under the.

Work With The Fixed Asset Write Off Note

What Is The Difference Between Fixed Asset Write Off And Disposal Wikiaccounting

Chapter 9 Fixed Assets Accounting 21st Edition Warren Reeve Fess Ppt Download

0 Response to "Write Off Fixed Asset"

Post a Comment